By Tony Kaye, Senior Personal Finance Writer, Vanguard Australia

Listed infrastructure companies have long had a reputation for providing stability to investors, because the revenue streams they generate from their large customer bases are generally secure.

Those revenues generally translate into stable high dividend yields, which in an environment of record low interest rates is extremely attractive to income seekers.

But the COVID 19 pandemic has put listed infrastructure companies to the test.

Governments around the world have been forced to lock down their economies to combat the virus’s spread. With that, travel restrictions have curtailed the revenues of listed airports, transport companies, toll road operators and others providing infrastructure services.

As a consequence, many infrastructure companies that have traditionally paid high-yield returns have needed to cut their dividend payouts.

The broader infrastructure picture

Yet, when compared against the broader market, infrastructure dividend yields have fared pretty well on a broader basis.

Why is that? The fact is, infrastructure is made up of quite a diverse field of companies in very different sectors.

While COVID has indeed had a big impact on sectors such as transportation, other infrastructure segments have been less affected. The operating experiences of the companies within those segments has varied considerably.

Investors with broad exposure to infrastructure through exchange traded funds (ETFs) or managed funds have therefore had a more stable experience than investors with a narrower exposure via individual companies.

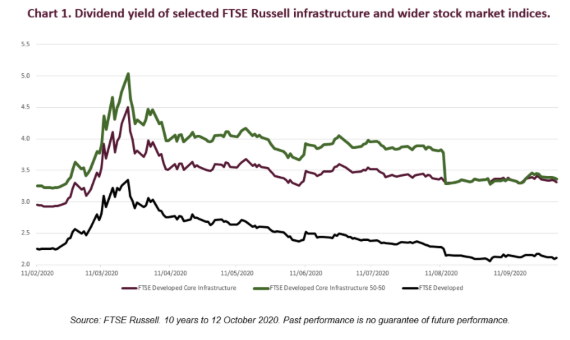

Research just completed by global stock market indices provider FTSE Russell shows the dividend yield performance of two infrastructure indexes against each other, and against the broader market.

In the chart below, the index shown in the green line (the FTSE Developed Core Infrastructure 50: 50 Index) has a much higher weighting in transport services stocks (21.6 per cent) versus the FTSE Developed Core Infrastructure Index (3.3 per cent), which is the brown line in the middle.

The FTSE Developed Core Infrastructure 50: 50 Index is weighted across three broad infrastructure sectors – 50 per cent utilities, 30 per cent transportation (including capping of 7.5 per cent for railroads) and a 20 per cent mix of other sectors including pipelines, satellites and telecommunication towers.

Company weights within each group are adjusted in proportion to their investable market capitalisation.

The FTSE Developed Core Infrastructure Index (the brown line) has the same number of constituents as the 50:50 index but different investment weightings.

The sharp drop in the FTSE Developed Core Infrastructure 50: 50 Index in August (shown in the chart) coincided with many transport companies in the index announcing cuts to their investor dividend payouts, which saw their share prices fall.

The black line in the chart (the FTSE Developed Index) represents the composite dividend yield performance of thousands of large and mid-cap companies in developed markets.

You can see that the dividend yield gap between both the FTSE Developed Core Infrastructure Index and the FTSE Developed Core Infrastructure 50: 50 Index has widened significantly against the FTSE Developed Index (the broad market) during the COVID crisis. This underscores the relative stability of infrastructure yields.

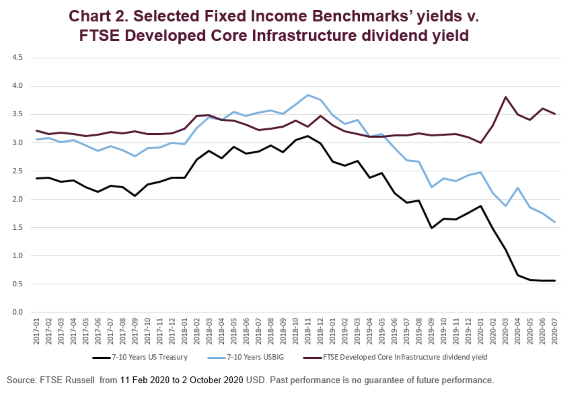

You also can see in the chart below how well infrastructure yields (the top line) have held up over time against the yields of most high-grade bond indices, which have fallen.

In short, the market consensus that low bond yields will be par for the course for quite some time adds weight to infrastructure investments for investors seeking yield.

Of course, dividend yield is only one part of the total investment equation. Capital growth is the other part, and together they equal the total return.

Taking a longer-term investment view, it’s important to focus on the total return – both prospective capital growth and income.

The road for investors

In response to the COVID crisis, governments around the world are collectively pouring trillions of dollars of new funding into infrastructure projects to stimulate economic growth.

It’s adding to their pre-existing funding commitments towards key construction projects, including airports, toll roads, utilities such as electricity, gas and water companies, as well as ports and railway networks.

User pay assets (toll roads, airports, ports and rail) are positively correlated to macro-economic growth and represent an attractive investment proposition in buoyant macro environments.

Utilities, because they meet basic consumer needs, are less sensitive to macro-economic cycles and unexpected events, making them a defensive and resilient segment.

Because infrastructure is such a diverse asset class, having broad exposure will undoubtedly deliver a much smoother investment ride over the long term.

Australian investors can readily gain access to diversified infrastructure funds via the Australian Securities Exchange (ASX) using an ETF, or via unlisted managed funds.

Please contact us on Phone 07 3340 5169 if you seek further assistance on this topic .

Source : Vanguard December 2020

Reproduced with permission of Vanguard Investments Australia Ltd

Vanguard Investments Australia Ltd (ABN 72 072 881 086 / AFS Licence 227263) is the product issuer. We have not taken yours and your clients’ circumstances into account when preparing this material so it may not be applicable to the particular situation you are considering. You should consider your circumstances and our Product Disclosure Statement (PDS) or Prospectus before making any investment decision. You can access our PDS or Prospectus online or by calling us. This material was prepared in good faith and we accept no liability for any errors or omissions. Past performance is not an indication of future performance

© 2020 Vanguard Investments Australia Ltd. All rights reserved.

Important: Any information provided by the author detailed above is separate and external to our business and our Licensee. Neither our business nor our Licensee takes any responsibility for any action or any service provided by the author. Any links have been provided with permission for information purposes only and will take you to external websites, which are not connected to our company in any way. Note: Our company does not endorse and is not responsible for the accuracy of the contents/information contained within the linked site(s) accessible from this page.